Investment impacts

The pop-out pages below provide more detail on the impact of our investments:

Camco exists to bring about a brighter future, today. Our work as a climate and impact fund manager is focused on catalysing investment into sustainable, clean and inclusive infrastructure and development in emerging markets. In doing so we are trying to make communities and their local environments more resilient to climate change while at the same time helping to avoid and reduce the greenhouse gas emissions that are causing climate change in the first place.

We understand that the best way to increase these critical investment flows is to convince investors that financing renewable energy and other forms of sustainable development have the potential to provide better risk-adjusted financial returns than more traditional investment options. Our unwavering belief in what we are doing certainly makes that challenge all the more simple.

This report is an evidence-based assessment of the impact Camco-managed funds have had as of 31 December 2022, and is our fourth Communication on Progress to the UN Global Compact.

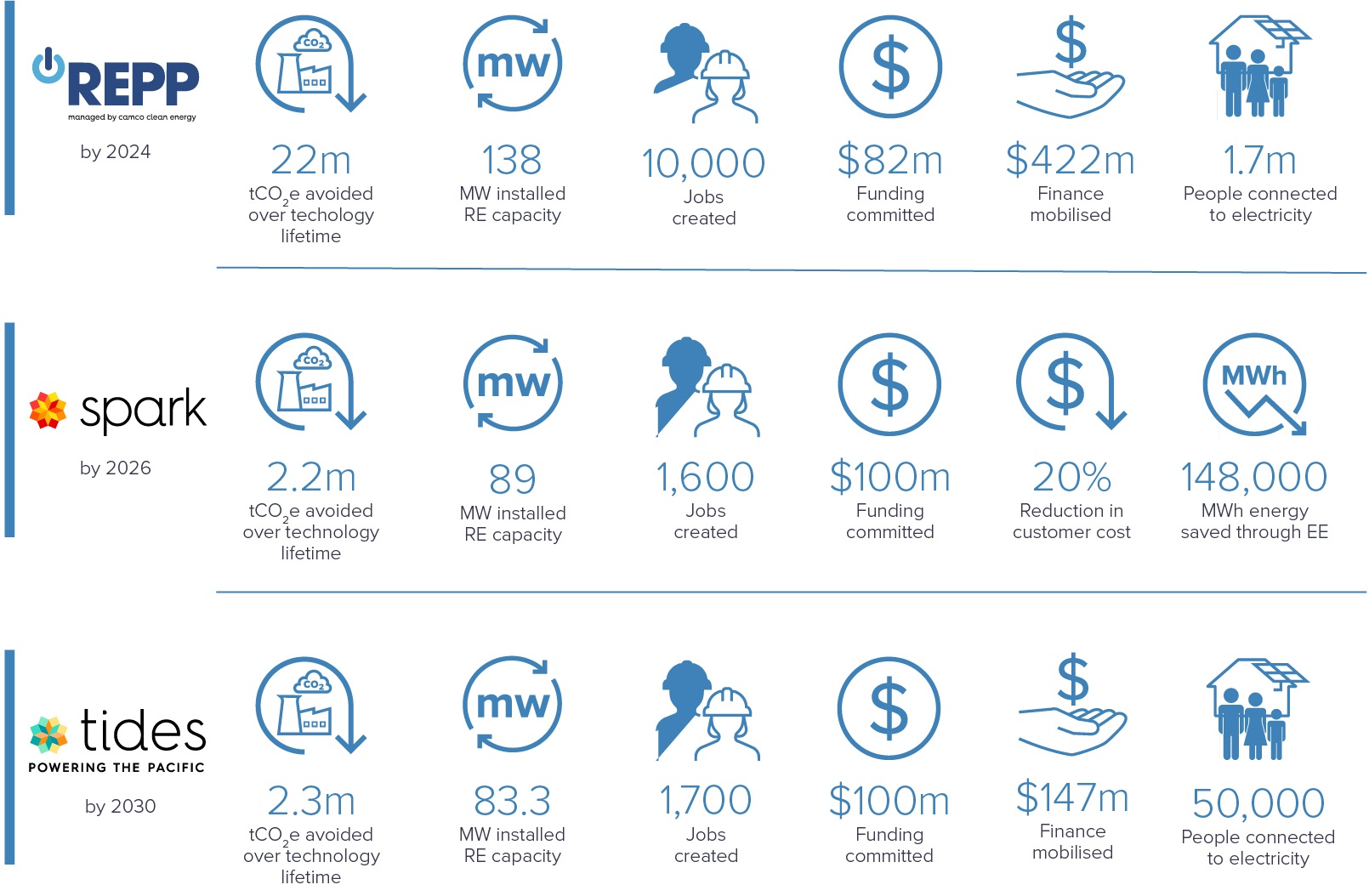

As you will see, 2022 proved to be another eventful year for Camco as we looked to consolidate and extend the transformational impact we have been achieving through the UK government-funded Renewable Energy Performance Platform (REPP) while progressing the several other funds that we manage or are designing, and which are at different stages of development.

During 2022, we began fundraising for REPP 2, a private debt fund designed and managed by Camco that focuses on renewable energy investment in Africa. It is structured as a blended finance facility to ensure an appropriate risk and return profile to investors and aims to deliver significant climate, environmental, economic and gender impacts.

Fundraising for Spark Energy Services (Spark), the innovative USD 100m finance platform we created to support the deployment of captive clean power and energy efficiency in Africa’s C&I sector, advanced significantly in 2022 and, at the time of writing, is expected to close shortly. Meanwhile, Spark is continuing to deliver tangible impacts on the ground through our USD 3m seed facility, most notably with the completion of a 400kWp solar installation at one of Coca Cola's oldest bottling companies in Kenya, representing the platform’s largest funded installation to date.

Our blended finance platform for the Pacific, Transforming Island Development through Electrification and Sustainability (TIDES), is also progressing well with its USD 100m raise, with prospective first loss providers having appointed the Pacific Region Infrastructure Facility to carry out market level due diligence. We also assembled an advisory board of highly experienced industry experts to advise on the future direction of the platform and its ambition of providing flexible financing to local renewable energy developers to catalyse investment in zero-emissions projects.

We were particularly excited to announce in March 2022 that we were teaming up with Energy Peace Partners to manage the Peace Renewable Energy Credit (P-REC) Aggregation Facility to support renewable energy development in vulnerable African states, and then at COP27 that we had signed an MOU with UNIDO to ramp up investments in climate-resilient agriculture in Southern Africa. I look forward to updating you on the progress of these and all other Camco-managed funds this time next year.

Of course, developing and fundraising for new funds while keeping up with the commitments of existing mandates is never easy, and I am forever in awe at the spirit and determination of my Camco colleagues for getting the job done. I would like to end therefore with a quick word of thanks to this enormously committed and talented group of people that I am proud to work with, and whose steely resolve and dedication to improving the lives of others lies behind all of the impact detailed in this report.

2022 saw Camco enjoying another year of steady progress punctuated with some exciting milestones and achievements along the way. These are some of the highlights:

In 2022, UK-funded REPP, managed by Camco, passed the major milestone of connecting more than one million people in Africa to electricity for the first time. The achievement was accomplished through REPP’s diverse portfolio of solar mini-grids, solar home systems and isolated grid projects (metro grids). By the end of the year, nearly 1.3 million people had been connected.

Six community-based clinics in Lesotho were connected to solar PV mini-grids in 2022 thanks to a REPP-funded project. The mini-grids include battery storage and provide the health centres with a clean and reliable source of energy around the clock.

Camco played an active role at COP27, taking part in several side events and hosting four of our own to further some of the conference’s most significant conversations around climate finance and the role of the private sector in delivering climate action across Africa and beyond. We also teamed up with ESI Africa for the second year in running to deliver regular insights, commentary and interviews from on the ground at the climate talks, as well as providing additional updates and analysis via our social media networks. Find out more here.

Throughout the year, Camco’s staff continued to appear regularly as guest speakers and panellists at a wide range of important industry events, including at Green Climate Fund’s Global Programming Conference and Private Investment for Climate Conference and Alliance for Rural Electrification’s flagship Energy Access Investment Forum, among others. In December, Camco-managed REPP published a multi-stakeholder position paper setting out a series of recommendations on how to improve the bankability of Nigeria’s mini-grid policy and regulatory framework. Read it here.

Camco co-organised two capacity building webinars in early 2022 that brought together a spectrum of specialists to explore today’s most pertinent gender and inclusivity issues in Africa and the Small Island Developing States (SIDS). Topics under discussion ranged from girls’ lack of education and the importance of mentoring to how to improve women’s safety in the workplace and the widespread need for better access to funding for female clean energy entrepreneurs.

Camco has partnered with Energy Peace Partners to manage the P-REC Aggregation Facility. The Facility is an impact-focused fund unlocking finance for new renewable energy projects in fragile, energy-poor countries in Africa by providing upfront P-REC revenue – a certified energy attribute - to project developers in exchange for the ownership of P-RECs generated by the project.

REPP-financed developer Lidera Green Power commissioned a 2.5MW solar PV plant near the city of Diego in Madagascar, which is one of the most world’s most severely affected countries by climate change. The project, which has already installed 5.3MW solar capacity at two other sites following REPP’s loan, is the first large-scale PV hybridisation of HFO plants in Madagascar and is contributing to the country’s energy security and climate resilience.

Camco is working with United Nations Industrial Development Organization (UNIDO) to develop our blended finance platform, Resilient Investment in Southern Africa (RISA), which is focused on climate change adaptation and building climate resilience within the region’s food and agriculture value chains. The two parties signed a Memorandum of Understanding at COP27 in November.

In 2022, Camco established an advisory board made up of specialists with significant local and climate finance experience to provide direction on the future design of the blended finance platform for the Pacific. Also during the year, Camco’s TIDES team continued to progress the platform and establish an on-the-ground presence with the support of USD 200k design funding from Convergence and the Australian Government, while PRIF was appointed by prospective first loss providers to conduct market level due diligence.

Camco welcomed four new joiners in 2022, including investment director Brian Lukera Wambani, whose wealth of expertise and experience working across a diverse array of investment and financial roles in East Africa is exceptional and convinced us that he was the ideal candidate for the role during an eagerly contested recruitment process. Meet the team.

In 2022, Camco was featured in ImpactAssets 50™, the world's best known database listing fund managers who have consistently demonstrated a commitment to delivering social and environmental impact. The listing is recognition of Camco’s work as a leading climate and impact fund manager in emerging markets.

Further impact and ESG indicators are provided later in the report under Creating Sustainable Value.

Camco is a climate and impact fund manager leading the transition in emerging markets.

Intentionality

We invest in activities that primarily contribute to the mitigation of and adaptation to climate change, and promote inclusive, resilient and sustainable development. These investments have the additional co-benefits of providing jobs, improving livelihoods, reducing air pollution, promoting gender equity and mobilising climate finance, which are elaborated on in the later section.

Camco’s sustainable investment objectives

Specifically, REPP, Spark and TIDES are each aligned with the environmental objectives of Article 9 of the Sustainable Finance Directive Regulation (SFDR) and EU Taxonomy Regulation on climate change mitigation and adaptation.

Responsible investing

We engage in responsible investment that incorporates environmental, social and governance (ESG) factors into investment decisions to better manage risk and generate sustainable, long-term returns for all stakeholders.

All investment activities carried out by Camco are governed by our own policies and procedures, as well as those applying to the third-party funds that Camco manages.

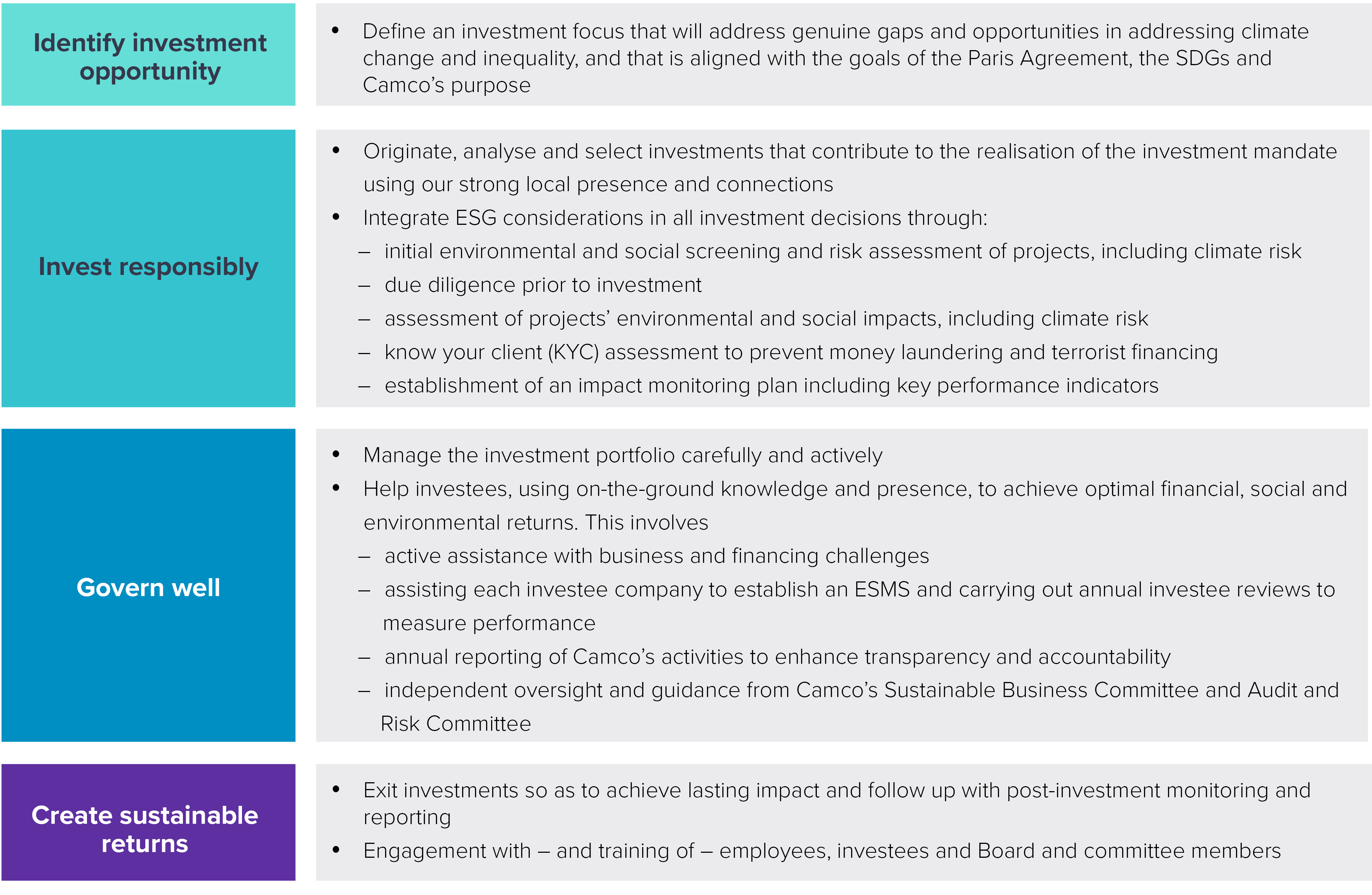

Camco's investment approach:

Find out more about our impact approach in the following pop-out pages:

Sustainability underpins everything we do and strive for at Camco.

Through its management of REPP, Camco is working to stimulate the development of a vibrant, networked and viable market for small and distributed renewable energy projects in African countries. Such a market is fundamental to helping to ensure access to affordable, reliable and sustainable energy for all of the nearly 600 million people still living without electricity in West, Central, East and Southern Africa and for taking urgent climate action. The region accounts for approximately 80% of all people currently without energy access in the world.

Similarly, commercial and industrial (C&I) businesses operating in Africa face major energy challenges that make it difficult to run their businesses profitably and sustainably. The Spark facility targets the efficient deployment of capital for renewable energy and energy efficiency project implementation in Africa’s C&I sector. This requires the execution of many small deals without introducing unnecessary financial risk, which it does by partnering with - and building the capacity of - suitable project developers.

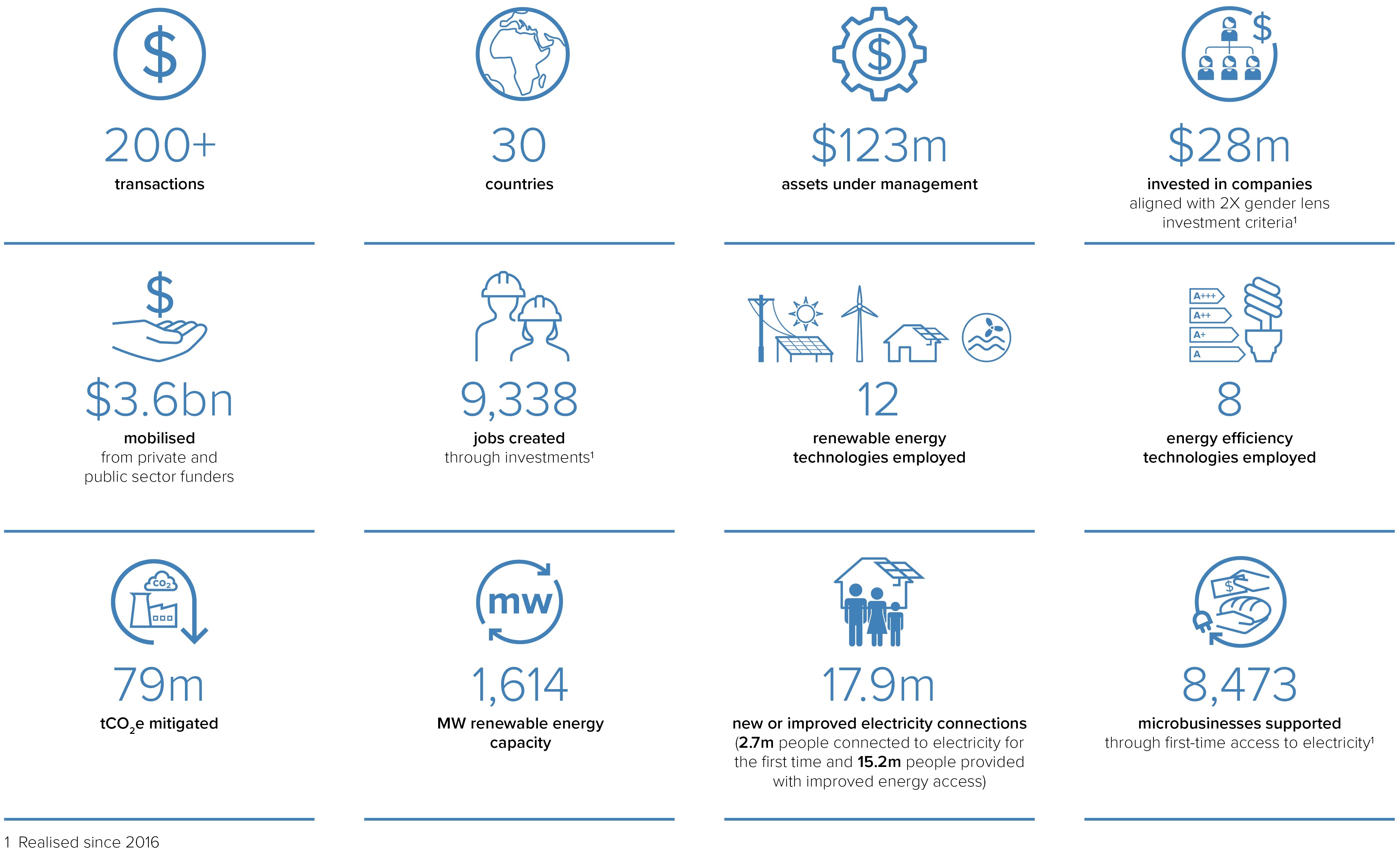

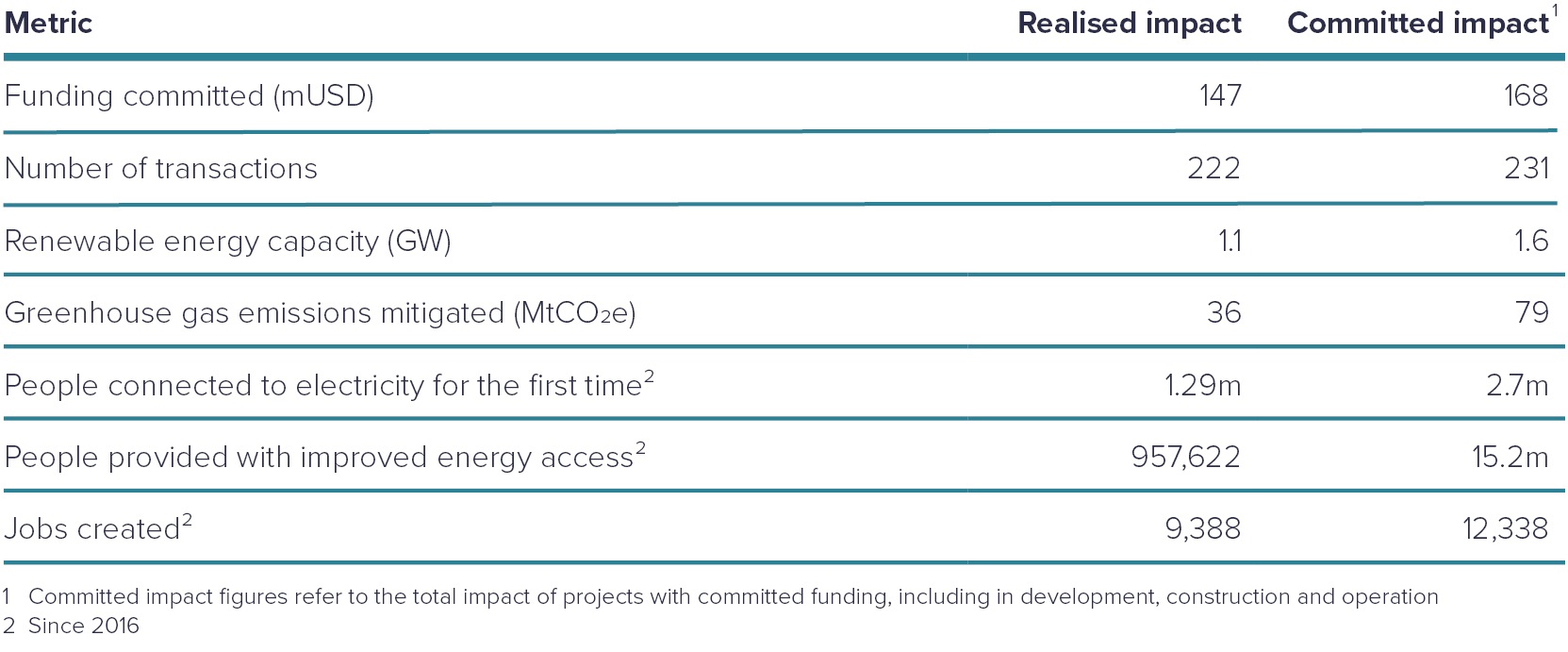

The table below shows the cumulative impacts that have been realised by Camco-managed funds and climate change mitigation projects since the company’s inception in 1989, as well as expected impact based on committed funding.

The table and investments impacts data below refer to fund-specific impact targets and results for REPP, Spark and TIDES.

The expected cost effectiveness of the mitigation actions over all three funds’ combined lifetime is:

The pop-out pages below provide more detail on the impact of our investments:

The pop-out pages below provide details on Camco's own operations:

Targets 7.1 and 7.2

By investing in innovative renewable energy and energy efficiency solutions in emerging and developing markets, Camco contributes towards access to afforbale, reliable, sustainable and modern energy for all.

Targets 9.1 and 9.4

By investing in projects to upgrade and retrofit industries to make them sustainable and resource-use efficient as well as increase the adoption of clean and environmentally sound technologies, Camco is helping to build resilient infrastructure, promote inclusive and sustainable industrialisation and foster innovation.

Target 11.1

Makes cities and human settlements inclusive, safe, resilient and sustainable – by providing affordable, inclusive, sustainable and low-carbon energy services to communities.

Targets 13.1 and 13.2

By decoupling economic growth and carbon emissions, strengthening communities’ resilience and adaptive capacity to climate-related hazards and natural disasters, and supporting the implementation of countries’ climate policies, Camco is directly supporting efforts to undertake urgent action to combat climate change and its impacts.

Targets 1.4 and 1.5

End poverty in all its forms everywhere – by providing first-time access to electricity, decent jobs and livelihood opportunities.

Target 3.4

Ensure healthy lives and promote well-being for all at all ages – by limiting pollutants through deployment of clean technologies.

Target 5.5

Achieve gender equality and empower all women and girls – gender equality and female empowerment is a crucial part of the solution to many central development challenges, including the clean energy transition. Camco invests in women-owned or managed businesses and actively promotes gender equality and social inclusion through our diversity action plans, both internally and through the projects we support.

Targets 8.4 and 8.5

Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all – by increasing the number of high quality, skilled jobs available and supporting business growth.

Target 17.3

Strengthen the means of implementation and revitalise the global partnership for sustainable development by mobilising private and public capital towards sustainable development in developing countries.

Bold and transformational steps are needed to shift the world onto a sustainable and resilient path. In recognition of this, we work in partnership with actors from the private, public and not-for-profit sectors to finance and implement clean energy projects, as well as to contribute to knowledge development and advocacy to strengthen the enabling environment for the implementation of the Paris Agreement and the 2030 Agenda.

Camco brings developers, financiers and risk mitigation providers together to successfully advance renewable energy development. During 2022, Camco-managed REPP continued to work successfully with its partners to help investees scale their operations and reach financial close. This included sharing the due diligence of several REPP transactions with our partners, allowing for a quicker investment process. Mobile Power, a REPP investee, has mobilised further funding from Beyond the Grid Fund and Innovative Fund UK. Following REPP’s investment, Energicity – a mini-grid developer in Sierra Leone - has secured further funding to roll out mini-grids in other countries in West Africa. By the end of 2022, REPP had mobilised USD 437m climate finance of which 34% came from private sources.

During 2022, Camco continued to actively engage with governments and industry associations to advocate for improvements in the enabling environment for renewable energy development. In partnership with the Africa Mini-grid Developers Association (AMDA) and the Nigeria Renewable Energy Association (REAN), Camco engaged with the energy regulator in Nigeria to successfully advocate for improvements in the mini-grid regulations, improving the bankability of the envisaged updated regulatory framework.

Camco continued to develop its understanding of the policy landscape in its target markets and ensure that its investments support national climate and sustainable development priorities. Through multiple public engagements at national and international forums, Camco continued to advocate for a stronger public-private collaboration and the strengthened role of the private sector as a partner for the implementation of national policy goals in developing and emerging markets. Through its Green Climate Fund-related activities, Camco continues to build strong partnerships with national policy makers and has secured national level support for its GCF applications from multiple countries, which further confirms the strong alignment of its work with national policy priorities.

The Camco-managed REPP fund is aligned with the 2X criteria for gender lens investing, with 46% of its funding invested to date to women-owned and led companies. We provide our investees with gender equality training and assist them in establishing gender action plans to improve gender equality within their operations and project implementation. REPP is also working in partnership with the 2X Collaborative to increase equitable climate finance flows through knowledge development and advocacy. In 2022, Camco worked with the 2X Collaborative to organise Africa and SIDS-focused online forums exploring how companies (and by extension, their funders) can better target women customers through distributed renewable energy business models and operations.